The Deliverance – Finding Clarity In Finances And Connections

It's almost like, many people wonder about their money once it's in a savings spot, particularly if they have to pay certain government fees. This is a pretty common thought, you know, especially when it comes to personal finances. People just want to be sure they are doing things the right way, and that can feel like a bit of a puzzle sometimes. So, figuring out what's what with your savings can feel like a real breakthrough, a moment of true clarity.

Apparently, there's a lot of talk about whether having funds in a savings account automatically means you owe something to the tax collector. Yet, the truth is, there are some special situations the rules allow for. This is a pretty important piece of information that can offer a kind of freedom from worry. It's about getting past those common beliefs and finding out what the actual regulations say, which can be quite a relief.

Actually, in a place like Argentina, financial dealings, such as keeping money, making investments, or using funds for daily life, usually involve some sort of payment to the government. But, one question comes up very often: how much can you put in your bank spot without needing to report it and pay those fees? This search for answers, for that precise number, can feel like a personal quest for financial ease, a genuine moment of the deliverance from confusion.

Table of Contents

- Financial Freedom – Understanding the Rules

- Are Your Savings Safe From Levies?

- The Deliverance From Financial Uncertainty

- How Much Can You Really Keep Without Telling the Authorities?

- Social Media Connections and The Deliverance of New Tools

- Sharing Your World and The Deliverance of Easy Creation

- When Access Is a Problem – Finding The Deliverance From Tech Glitches

- Making Videos You Love – The Deliverance of Simple Editing

Financial Freedom – Understanding the Rules

You know, there's a lot of chatter about money and what you need to do with it, especially when it comes to taxes. It's kind of like, people want to feel secure about their finances, and a big part of that security comes from knowing the rules. When you have funds tucked away in a savings account, it’s completely natural to wonder if those funds are going to be hit with extra charges. This thought, this little worry, can actually keep some people from feeling completely at peace with their financial arrangements. It’s a bit of a hurdle, isn't it? Gaining a clear picture of what applies to your savings can feel like a true liberation, a real step towards feeling more in control of your financial life. This kind of insight is, in some respects, a form of the deliverance from daily money worries.

For example, in Argentina, the money you put into a savings account, whether it's in pesos or dollars, is usually free from certain personal asset taxes. This is true, provided the money stays in that account until a specific date, like December 31st. This particular rule is a big deal for many people. It means that just having funds in a savings spot doesn't automatically trigger a tax payment for those assets. It's a key piece of information that can really change how you think about your savings. Knowing this detail can certainly bring a sense of calm, a feeling of being less burdened by potential financial obligations. It’s a very important distinction that helps people make choices with more confidence.

However, it's pretty common for people to think that just having money in a savings account automatically means they'll have to pay taxes on it. But, as we've seen, there are specific situations where this isn't the case. These exceptions are actually written into the law. So, it's not about guessing; it's about looking at what the official guidelines say. This clarity, this specific guidance, offers a way out of that general assumption. It gives people a solid ground to stand on, rather than just going by what they might have heard. This is, in a way, a moment of the deliverance from widespread misconceptions about money and taxes.

Are Your Savings Safe From Levies?

So, is your money in a savings spot truly safe from certain government charges? The simple answer, generally speaking, is yes, for a particular kind of charge. We're talking about the personal asset tax here. Funds kept in savings accounts, whether they are in the local currency or in dollars, are considered exempt from this specific tax. This applies as long as those funds remain in the account on a certain date, which is typically December 31st. This piece of information is quite significant for anyone trying to manage their finances effectively. It means you can hold your savings in these accounts without having to worry about that particular tax burden. It's a pretty straightforward rule, which helps to simplify things for many people. This clarity provides a certain measure of the deliverance from tax-related anxieties.

It’s important to remember that this exemption applies to the personal asset tax, not to all possible financial obligations. Other types of transactions or income might still have their own rules. However, for simply holding funds in a savings account, this exemption offers a clear benefit. It helps people feel more secure about keeping their money accessible while it's not being actively invested or spent. This rule helps to encourage people to use formal banking channels, which is good for the economy as a whole. It's a practical detail that brings a lot of peace of mind to individuals who are trying to make smart choices with their personal resources. Knowing these details can be a great relief, a sort of practical the deliverance from complex financial worries.

The Deliverance From Financial Uncertainty

Finding a way through financial uncertainty can feel like a real challenge, you know? It's kind of like, you're trying to do the right thing with your money, but the rules can seem a bit blurry sometimes. This is where clear information becomes so valuable. When you learn that certain savings are not subject to a particular tax, it takes away a layer of that worry. This clarity is a genuine form of the deliverance from the stress of not knowing. It allows you to breathe a little easier, feeling more confident about where your money is and what it's doing.

Recently, the government introduced a plan to help people sort out their assets, sometimes called a "regularization plan" or a "blanqueo." This plan gives people a chance to bring undeclared assets into the official system. It’s a very specific opportunity that can help individuals get their financial house in order. As part of this, it was decided that any money built up in an account before this new tax takes effect won't be subject to that new charge. This is a pretty big deal, offering a path to clear up past financial situations without facing new penalties on old funds. This measure provides a powerful sense of the deliverance for those looking to get their finances transparent and compliant.

How Much Can You Really Keep Without Telling the Authorities?

A question that pops up a lot, like, all the time, is about how much money you can put into your bank account without having to report it and pay taxes. This is a very practical concern for many people. The amount you can hold in the bank without needing to declare it actually changes depending on your personal financial situation, especially your declared income. It’s not a one-size-fits-all number, which can make it a little tricky to figure out. But, understanding this limit is key to staying on the right side of the rules. It’s about knowing your personal threshold, so you can manage your funds with peace of mind. This knowledge is a form of the deliverance from potential financial missteps.

Generally speaking, if you don't have any declared income, the highest amount of money you can have in the bank without needing to declare it is around $200,000. This amount covers not just the money sitting in your savings account but also other funds you might have in the bank. So, it's a total figure across your bank holdings. Banks, apparently, don't usually share these specific limits openly, which can add to the confusion for individuals. This makes it even more important for people to seek out this information themselves. Knowing this specific cap is incredibly helpful for managing personal finances responsibly and avoiding any unexpected issues. It offers a clear boundary, which is, in a way, a practical the deliverance from financial guesswork.

Social Media Connections and The Deliverance of New Tools

Moving from money matters, let's talk about how we connect with others and share our lives online. You know, social media platforms are kind of like places where we can find friends, meet other people who like the same things we do, and see what everyone around us is up to. It’s about exploring your personal interests and showing what’s happening in your world. This ability to connect and share, to really feel part of something, can be a wonderful thing. It offers a sense of belonging, a feeling of being understood, which is, in some respects, a form of the deliverance from feeling isolated.

However, sometimes these platforms can have their quirks. For instance, some people feel that one popular video app actually has a less than ideal way of saving things, which can be a bit frustrating. So, when another popular photo and video app starts to copy that system, it can feel like a strange and annoying change. It’s like, why make things harder when they could be simpler? Also, this same photo and video app is making all videos posted into short, looping clips, unless they are very specific kinds of content. These changes can be a bit of a hurdle for users who are used to doing things a certain way. Finding solutions to these little frustrations can feel like a mini-deliverance in the daily use of technology.

Sharing Your World and The Deliverance of Easy Creation

When it comes to sharing your world, whether through pictures or videos, you want the process to be smooth and enjoyable. People want to create and find short, fun videos on platforms, like those short, looping clips. They also want to post photos and videos to their main profile that they want others to see. This ability to easily share what you're passionate about, what you're doing, and what you care about, is a core part of what makes these platforms appealing. It's about expressing yourself without unnecessary difficulty. When the tools work well, it feels like a real moment of

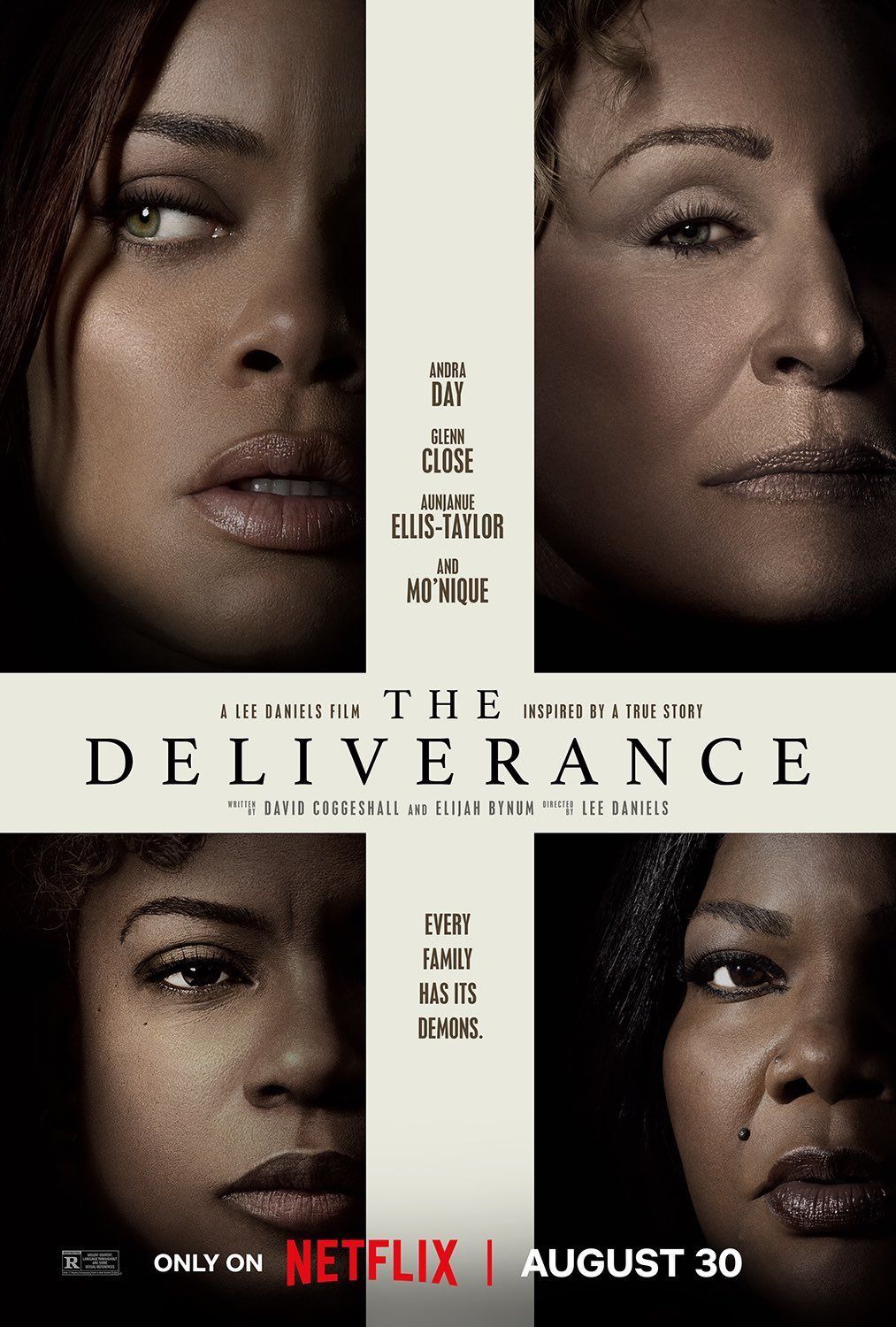

Lee Daniels Reveals What 'The Deliverance' Is Really About

The Deliverance (2024) | MovieWeb

The Deliverance Pictures | Rotten Tomatoes